closed end loan examples

Open end credit is when a borrower can spend up to a certain amount. 60 monthly payments of 3025 per 1000 borrowed.

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

Professional and Secure Legal Solutions Personalized by You.

. Ad Create a Custom Loan Contract to Ensure Payment Within a Specified Time Period. Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Home mortgages and car loans are two common examples.

Definition and Examples of a Closed-End Home Equity Loan. There are a few common ways you may use closed end credit such as. For a 25000 auto loan for a term of 60 months with a 275 APR the monthly payment will be ______.

A closed-end signature loan is a type of personal loan that is typically available to people with good credit. Home equity lines of credit HELOC and credit cards on the other hand are examples of open-end loans. Obtaining a closed-end loan is an effective way for a borrower to establish a good credit rating by demonstrating that the borrower is creditworthy.

An auto loan is an example of this. A closed-end loan is a type of loan in which a fixed amount is borrowed and then paid back over a specified period. This has varying payment depending on how much you spend.

Posted at 2034h in when will russian stock exchange open by william shaner gold medal. A payday loan is generally a small loan of money that may include high fees and repayment terms as short as 14 days. While a traditional mortgage gives you the money to buy a home a.

Closed End Personal Loan. Such a loan is set up with fixed payments that cover both the principal amount of the loan and the interest due over the life of the loan. Mortgage loans and automobile loans are examples of closed-end credit.

Payments are usually of equal amounts. One example of open end credit is credit cards. As mentioned before auto loans and real estate are examples of closed-end credit.

Payments on a Closed-End Loan. For example if you. An open-end loan is a revolving line of credit issued by a lender or financial institution.

Youd do it by putting up the house as collateral for the new loan. A closed-end loan is frequently an installment loan in which the loan is issued for a specific amount and repaid in installment payments on a predetermined schedule. Although these loans usually have a specific purpose a personal loan that you can borrow for any purpose also falls under the closed-end credit category.

Personal loans are also often close-end. The most common examples of closed-end credit are mortgages and auto loans where the purpose of taking out a loan is known and definite. Personal lines of credit and credit cards.

These loans are normally disbursed all at once in order for the debtor to buy or achieve a specific thing and often the creditor gains rights to possess the item if the debtor fails to repay the loan. Give three examples of closed ended loans give three examples of closed ended loans. An example of a closed end personal loan is a debt consolidation loan.

A closed-end home equity loan is similar to a traditional home mortgage. Why It Is Important. When you borrow money with a closed-end loan you are agreeing to make installment payments which include principle and interest divided in equal amounts and applied to a repayment.

Examples Examples of closed-end loans typically appear in installment loans. A repayment example may also be stated as a unit cost. Closed- and Open-End CCH Site Builder.

Online lenders credit unions and banks offer a closed-end lending option. Is offered by a lender only when the borrower provides collateral for the loan. Mortgages auto payments and student loans are the most common.

Both loan types allow you to borrow a set amount which you repay through monthly principal and interest payments. Sometimes referred to as revolving credit lines credit cards and home equity lines of. Closed End Credit Examples.

Payday loans are also an example of closed-end consumer loans. An open end loan also known as a line of credit or a revolving line of credit is a type of loan where the bank offers credit to the borrower up to a certain limit and giving the borrower the freedom to use the amount of credit it needs whenever it is needed. In other words the borrower has the right to tap into the credit made available to.

How Do Closed-End and Open-End Credit Differ. Both loan types use your home as collateral. An agreement or contract lists the repayment 9.

A loan can be closed-end or open-end. A closed-end loan is to be contrasted with an open-ended loan where the debtor borrows multiple times without a specified repayment date like with a credit card. A secured credit card and home equity 10.

An example of a closed-end loan is a mortgage loan. A closed-end loan is one in which the borrower receives a sum of money that they must repay by a certain date often in monthly installments. Two Types of Credit.

Unsecured Closed End Credit. Examples of closed-end loans. A closed-end loan is also known as an installment loan by traditional lenders.

By contrast open-end loans such as credit cards can have the amount owed go up and down as the borrower takes money against a credit line. They have a set interest rate usually determined by the credit score and other financial information provided on the loan application. This loan has a set term amount and interest rate agreed upon 18.

Real estate and auto loans in general are closed-end loans. Give three examples of closed ended loans. Give three examples of closed ended loans 01 Apr.

By comparison loans for a predetermined amount such as auto loans are considered to be closed-end loans. Auto loans and boat loans are common examples of closed-end loans. Mortgage loans and automobile loans are examples of closed-end credit.

Closed end credit is a loan for a stated amount that must be repaid in full by a certain date. A secured open-end loan on the other hand is a line of credit that requires collateral for approval. With traditional open-end mortgages youd be free to borrow against that 200000 in the form of a home-equity loan.

Which is the best example of open end credit. The length of the loan will affect how much you end up paying overall. As mentioned earlier personal loans auto loans mortgages and student loans are examples of closed-end credit.

Open-end loans offer you the chance to borrow as much or as little money as you want up to a certain amount and then pay back some or all of the funds monthly.

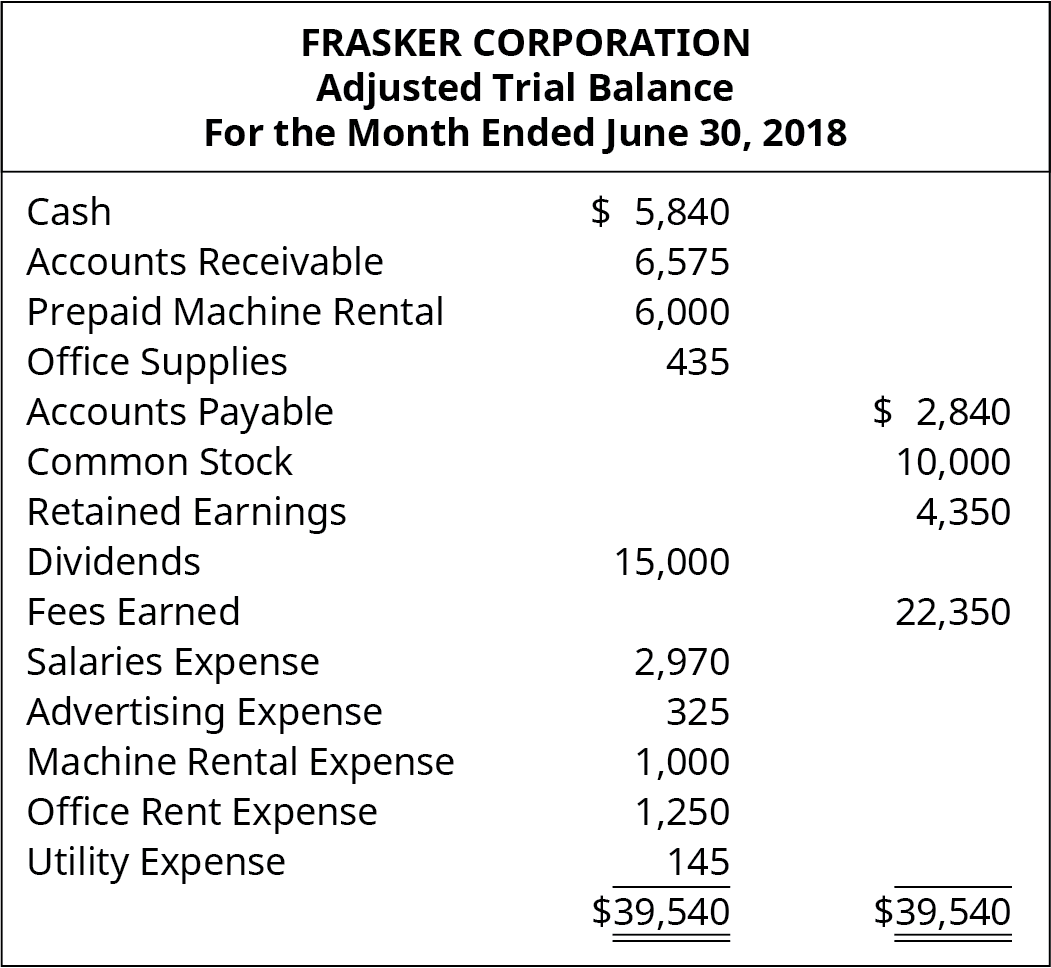

Describe And Prepare Closing Entries For A Business Principles Of Accounting Volume 1 Financial Accounting

Consumer Loan Types And Categories Of Consumer Loan With Example

:strip_icc()/what-to-know-before-getting-a-personal-loan-e4d1a8b84f154c87b0615537de2aa520.jpg)

How Long Does It Take To Get A Loan

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Hdfc Bank Personal Loan Closure Letter 2 Samples Format

Understanding Different Types Of Credit Nextadvisor With Time

Truth In Lending Act Tila Consumer Rights Protections

Request Letter To Bank For Closing Loan Account 5 Samples 2021 New Format

Loan Officer Job Description Expected Salary And What Your Day Will Look Like

:max_bytes(150000):strip_icc()/what-to-know-before-getting-a-personal-loan-e4d1a8b84f154c87b0615537de2aa520.jpg)

How Long Does It Take To Get A Loan

Adjusting Entries For Liability Accounts Accountingcoach

Home Equity Line Of Credit Statement Overview

Letter Of Commitment Overview Example And Contents

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

/alta-sellers-closing-statement-26837264d4044785a5d0409dae83a510.jpg)

/GettyImages-923217650-70de1e010cdd4448b137a93421018b33.jpg)

:max_bytes(150000):strip_icc()/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)

:max_bytes(150000):strip_icc()/what-are-differences-between-delinquency-and-default-v2-dfc006a8375945d4b63bd44d4e17ffaa.jpg)