change in net working capital formula dcf

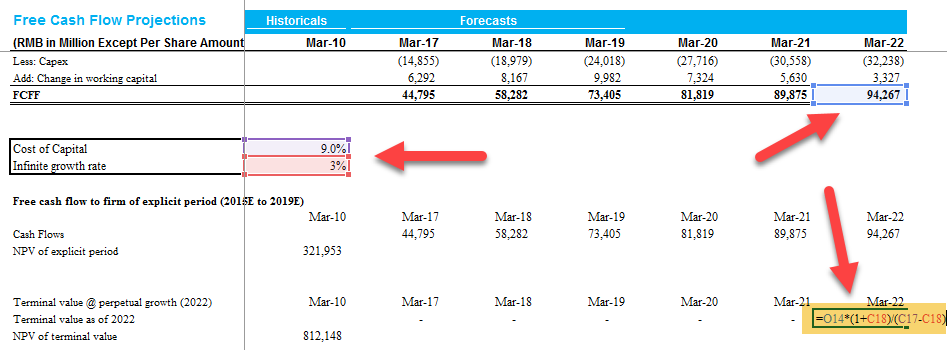

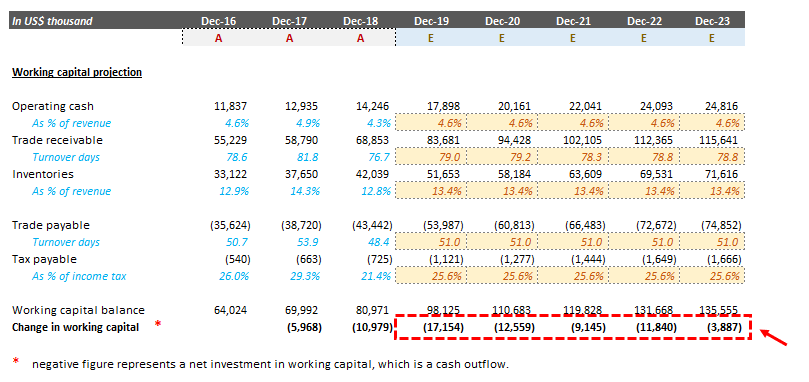

Also calculate Long term growth rate using GDP and Inflation rate. Changes in working capital -2223.

Change In Net Working Capital Nwc Formula And Calculator

When they report a net income of 15 million but only pay out 5 million it increases its equity capital by 10 million.

. Hey guys I am trying to understand change in NWC and how it relates to the FCF and overall cash position of the company. Free cash flow decreases. Now changes in net working capital are 3000 10000 Less 7000.

Cash on hand varies for different companies but having. The logic behind subtracting net working capital is as such. In this case the change in working capital is computed using the formula above and it is dramatically less.

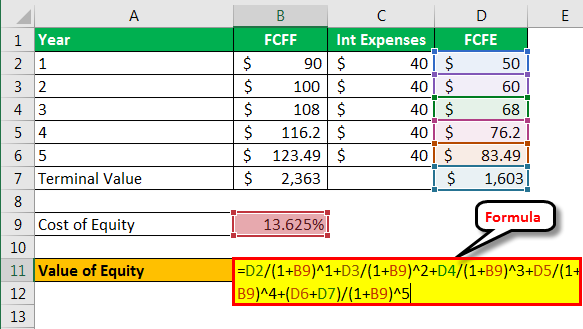

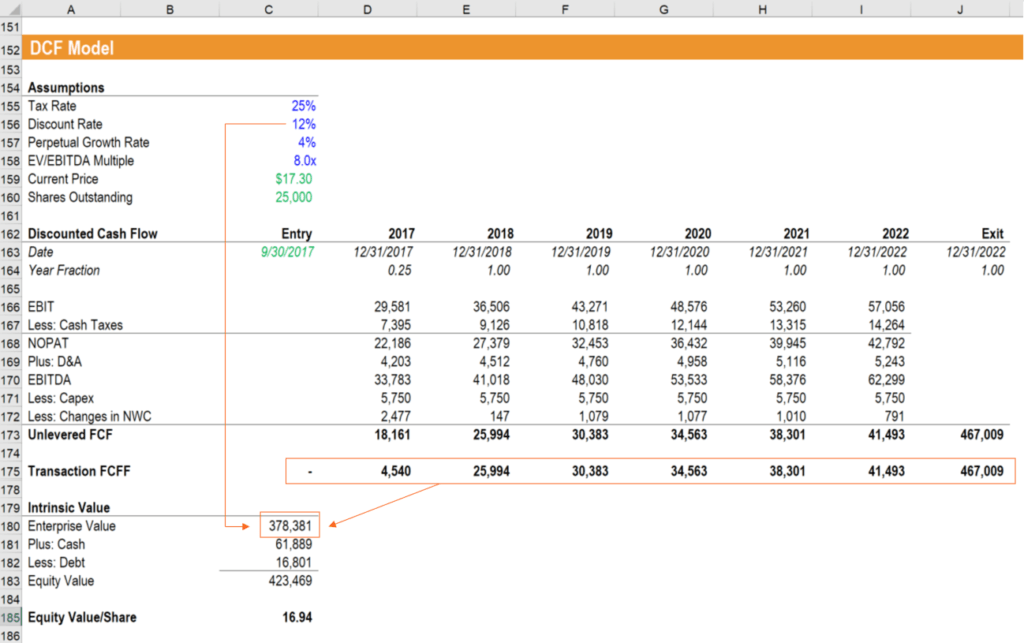

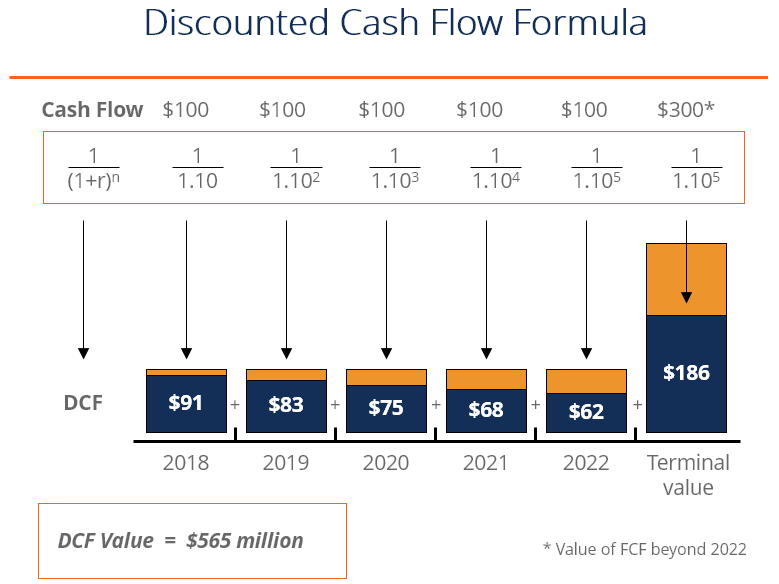

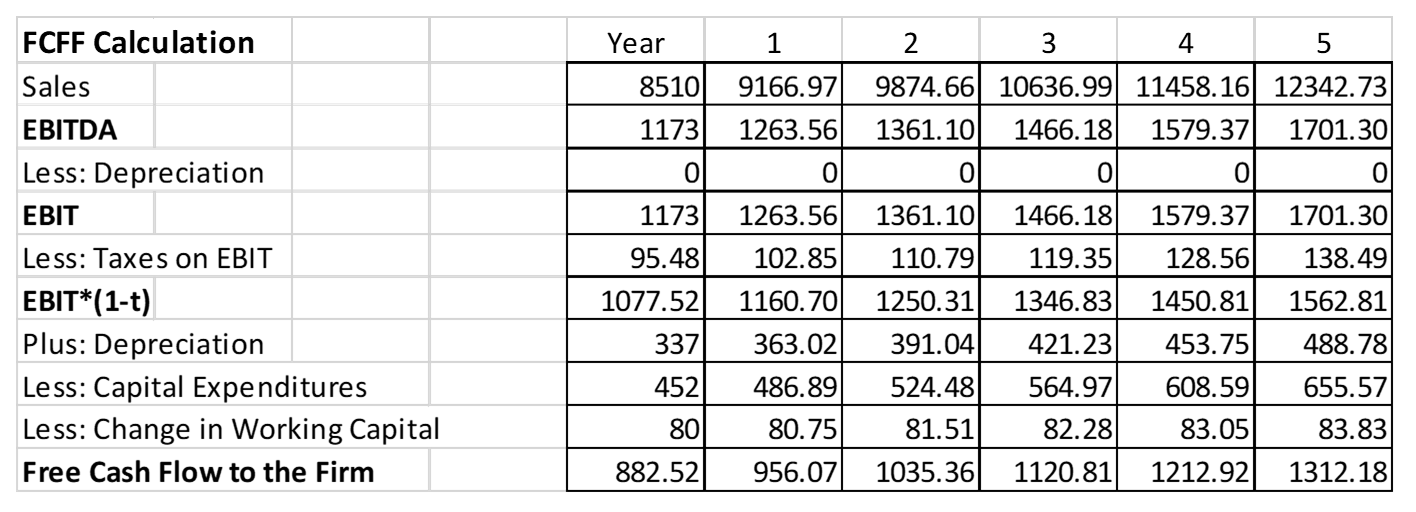

Recall the formula for the net present value of. For this in a separate sheet also calculate NOPAT and CWC. Cash Flows from Operations is calculated as the net income adjusted for changes in net working capital and noncash expenses such as depreciation and amortization.

In 3-statement models and other. Whenever working capital increases on a net basis it. The discounted cash flow model commonly referred to simply as DCF is one of the most used methods to value a company.

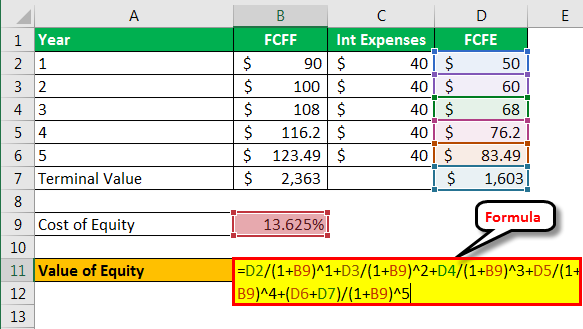

You discount the FCFF to its present value using the WACC. The non-cash working capital for the Gap in January 2001 can be estimated. The change in net working capital formula is given as N E B where E is ending net working capital and B is beginning NWC.

The Change in Working Capital gives you an idea of how much a companys cash flow will differ from its Net Income ie after-tax profits and companies with more power to collect cash quickly from customers and delay payments to suppliers tend to have more positive Change in Working Capital figures. FCFF NOPAT D. Answer 1 of 6.

It requires building a DCF model spreadsheet usually in Excel. Change in Net Working Capital 5000. You include change in cash as a part of change in overall working capital.

Therefore the most used and theoretical sound valuation method for determining the expected value of a based on its projected free cash flows. For year 2020 the net working capital is 10000 20000 Less 10000. As I initially understood it a higher NWC indicates the company has the capability to pay its current liabilities and thus is in a better position.

Since the change in working capital is positive you add it back to. For example a bank with a 5 Tier 1 capital ratio can make 100 in loans on each 5 in equity capital. Create a separate sheet name it 5YRGR and calculate 5 years Grow rate.

Working capital increases. In this case the change is positive or the current working capital is more than the last year. For the year 2019 the net working capital was 7000 15000 Less 8000.

The formula is. Working Capital The Gap. However a higher NWC year over year actually means a lower FCF.

Heres the formula for free cash flows Ill be referring to. That in turn allows the bank to loan out 200 in the next period and hopefully grow its equity in the future. A DCF would value your subject company based on the cash flow available to its financial owners not its cash balance.

The changes in working capital are discounted using the WCSales ratio working capital over sales which in this case is 80. Positive cash flow indicates that a companys liquid assets are increasing. Free cash flow decreases.

The discounted cash flow DCF valuation is used to calculate the present value of a firm by discounting the expected returns to their present value by using. The DCF valuation method is widely used. If a transaction increases current assets and.

If a company stock piles a ton of cash you can treat some of it as excess cash and tack it back on after youve completed the entire DCF valuation. In Table 1010 we report on the non-cash working capital at the end of the previous year and the total revenues in each year. Non-cash working capital 1904 335 - 1067 - 702 470 million.

Calculate FCFF Free Cash flow to the firm. Under ordinary operating conditions many if not most companies have positive working capital current assets exceed current liabilities so forecasted increases in revenues require additional working capital investments and free cash flow is reduced all else held constant. Discounted Cash Flow Valuation is a form of intrinsic valuation and part of the income approach.

Owner Earnings 8903 14577 5129 13312 2223 13084. When you use the lower number for changes in working capital and then compute the net present value the result is consistent with the true theoretical number. For most companies you analyze by using the change in working capital in this way the FCF calculation and owner earnings calculation is similar as it.

The screenshots below illustrate the same type. Cash Flow is the net amount of cash and cash-equivalents being transferred in and out of a company. File with a little more detail.

It still counts as cash that is tied into running the day to day operations of the business. Operating Assets DCF WACC - Working Capital. FCF EBIT1-Tax Rate Depreciation and Amortization Capital Expenditures Increases in Net Working Capital NWC If you have an increase in net working capital you have more current assets than liabilities than you did in the previous period.

Change In Working Capital Video Tutorial W Excel Download

Discounted Cash Flow Analysis Street Of Walls

10 Of 14 Ch 10 Change In Net Working Capital Nwc Explained Youtube

Dcf Formula Calculate Fair Value Using Discounted Cash Flow Formula

Discounted Cash Flow Dcf Formula Calculate Npv Cfi

Projecting Net Working Capital For Free Cash Flow Calculation Dcf Model Insights Youtube

Discounted Cash Flow Create Dcf Valuation Model 7 Steps

Discounted Cash Flow Dcf Formula Calculate Npv Cfi

Discounted Cash Flow Dcf Formula Calculate Npv Cfi

Dcf Formula Calculate Fair Value Using Discounted Cash Flow Formula

Change In Working Capital Video Tutorial W Excel Download

Change In Working Capital Video Tutorial W Excel Download

Change In Net Working Capital Nwc Formula And Calculator

Explaining The Dcf Valuation Model With A Simple Example

Dcf Formula Calculate Fair Value Using Discounted Cash Flow Formula

Change In Net Working Capital Nwc Formula And Calculator

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy